Equity Risk Premium Brazil

Oct 26, 2023

·

1 min read

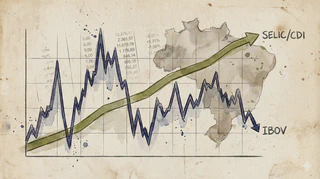

This project objective was to compare risk-free rate of Brazil (SELIC/CDI) versus equity returns measured by the Ibovespa Index (IBOV).

I gathered data from the time-series database from Central Bank of Brazil (BCB) and compared the returns in multiple windows to see which asset performed more. The asset who had a higher return was classified into a winner, then, I measured the percentage of wins through multiple windows.

At the time, the risk-free rate of Brazil (SELIC/CDI) have won more times than Ibovespa (IBOV).

If you want to see more details, go check out the repository on Github: https://github.com/gustavodemari/bovespa-x-cdi

Authors

Gustavo De Mari Pereira

(he/him)

Data Scientist & Machine Learning Engineer

M.S. in Computer Science from IME-USP, focused on Reinforcement Learning. Founder of 2 companies, 10+ years of experience

working with large-scale databases and building end-to-end ML pipelines. Kaggle competitor and Scikit-learn contributor.